Are you wondering if Capital One will lower your auto loan interest rate? You're not alone. Many borrowers find themselves in a situation where they need to explore options to reduce their loan costs. Whether you're facing financial hardship or simply looking to save money, understanding how Capital One handles auto loan interest rates is essential. Capital One is known for its customer-centric approach, but navigating their policies can sometimes feel overwhelming. This guide will walk you through everything you need to know about your chances of securing a lower interest rate and how to make the process smoother.

When it comes to auto loans, interest rates play a significant role in determining your monthly payments and the total cost of the loan. Capital One offers competitive rates, but they are influenced by several factors, including your credit score, income, and loan terms. If you're struggling with high interest payments, it's worth exploring whether Capital One can adjust your rate. The good news is that lenders, including Capital One, often have options for borrowers who qualify for refinancing or hardship programs. By understanding the steps you can take, you can increase your chances of securing a more affordable loan.

Lowering your auto loan interest rate isn't just about saving money—it's also about improving your financial health. High interest rates can strain your budget and make it harder to achieve other financial goals. With the right approach, you may be able to negotiate better terms or refinance your loan for a lower rate. In the following sections, we'll dive deeper into how Capital One handles interest rate adjustments, what you can do to improve your chances, and other options available to you. Let's explore the answers to your most pressing questions about "will Capital One lower my auto loan interest rate?"

Read also:Comprehensive Guide To United Insurance Company Of America

Table of Contents

- Can Capital One Lower My Interest Rate?

- What Factors Affect Auto Loan Interest Rates?

- How to Request a Lower Rate

- Will Capital One Lower My Auto Loan Interest Rate for Hardship?

- Options for Refinancing Your Auto Loan

- How to Improve Your Credit Score

- Is It Worth Refinancing with Capital One?

- Steps to Take If Your Request Is Denied

- Alternatives to Capital One for Auto Loans

- Frequently Asked Questions

Can Capital One Lower My Interest Rate?

If you're asking, "Can Capital One lower my interest rate?" the answer depends on several factors. Capital One, like most lenders, evaluates each borrower's situation individually. They consider your creditworthiness, payment history, and current financial circumstances. While there's no guarantee that they will lower your rate, there are specific steps you can take to improve your chances.

One of the first things you should do is review your loan agreement. Check if there are any clauses about interest rate adjustments or refinancing options. If your financial situation has improved since you took out the loan—such as a higher income or improved credit score—you may have a stronger case for negotiating a lower rate. Additionally, Capital One may offer hardship programs for borrowers experiencing financial difficulties, which could include temporary or permanent interest rate reductions.

It's also worth noting that Capital One may be more willing to adjust your rate if you have a history of timely payments. Lenders value reliable borrowers, so demonstrating your commitment to repaying the loan can work in your favor. Keep reading to learn more about the factors that influence auto loan interest rates and how you can position yourself for a successful negotiation.

What Factors Affect Auto Loan Interest Rates?

Understanding the factors that affect auto loan interest rates is crucial if you're wondering "will Capital One lower my auto loan interest rate?" Lenders use a variety of criteria to determine the interest rate you qualify for, and these factors can vary depending on your financial profile.

How Does Credit Score Impact Your Rate?

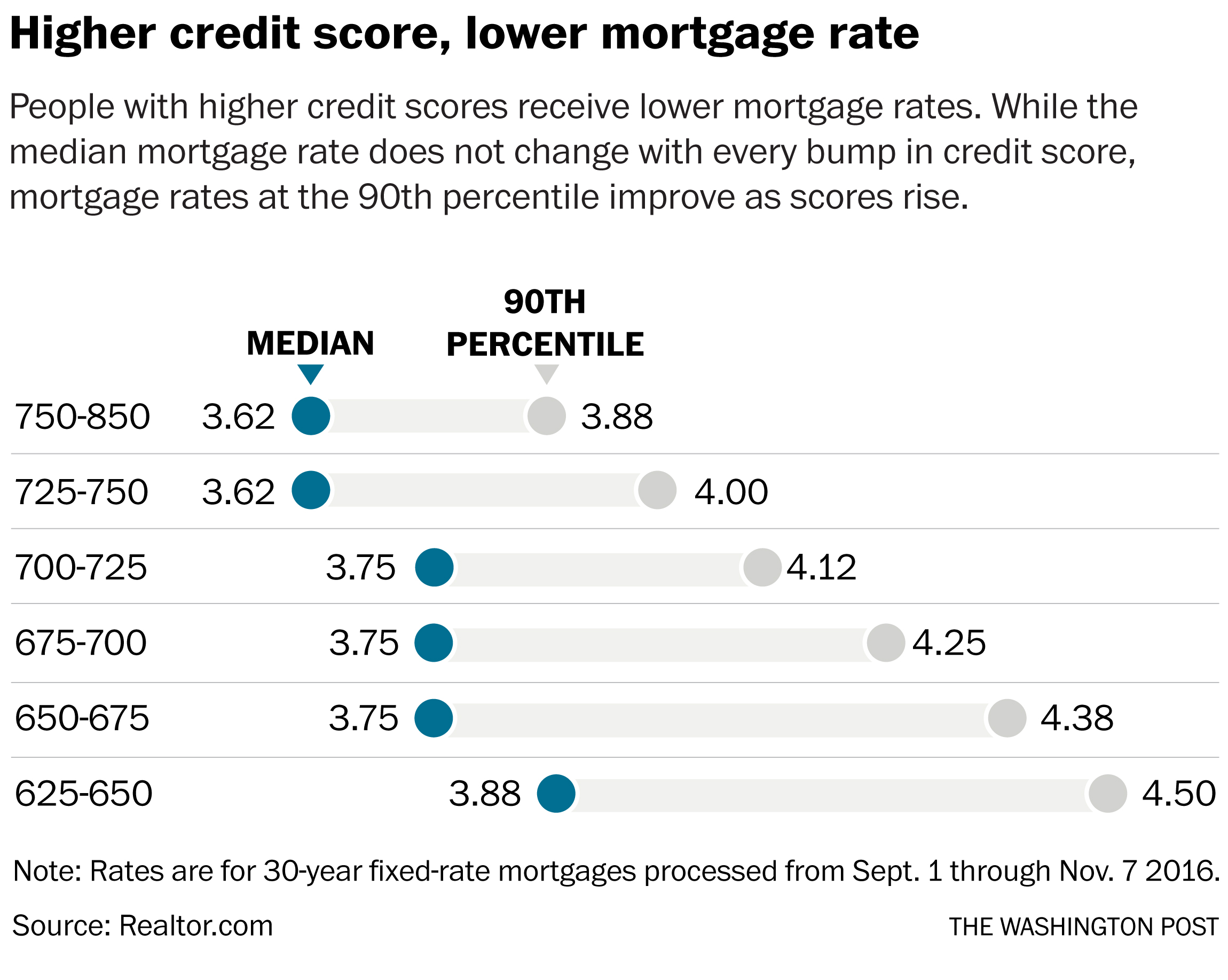

Your credit score is one of the most significant factors influencing your auto loan interest rate. Borrowers with higher credit scores typically qualify for lower rates because they are considered less risky by lenders. If your credit score has improved since you took out your loan, you may be eligible for a reduced rate through refinancing.

What Role Does Loan Term Play?

The length of your loan term can also impact your interest rate. Longer loan terms often come with higher rates because they represent a greater risk to the lender. If you're willing to shorten your loan term, you may be able to negotiate a lower rate with Capital One.

Read also:Liv Spencer Actress A Rising Star In Hollywood

Will Capital One Lower My Auto Loan Interest Rate Based on Income?

Your income is another factor that lenders consider when determining your interest rate. A stable and sufficient income reassures lenders that you can meet your repayment obligations. If your income has increased since you took out the loan, it's worth mentioning this when requesting a rate adjustment.

How to Request a Lower Rate

If you're ready to ask Capital One to lower your auto loan interest rate, preparation is key. Here are some steps to guide you through the process:

- Gather Your Financial Documents: Collect recent pay stubs, bank statements, and proof of any financial improvements, such as a higher credit score or increased income.

- Contact Capital One's Customer Service: Reach out to their customer service team to inquire about interest rate adjustments. Be polite but firm in expressing your request.

- Highlight Your Payment History: If you've consistently made on-time payments, emphasize this as a reason for why you deserve a lower rate.

Remember, the key is to present a compelling case that demonstrates your financial responsibility and improved circumstances.

Will Capital One Lower My Auto Loan Interest Rate for Hardship?

If you're experiencing financial hardship, you may be wondering, "Will Capital One lower my auto loan interest rate?" The good news is that many lenders, including Capital One, offer hardship programs to assist borrowers in difficult situations. These programs may include temporary interest rate reductions, payment deferrals, or other forms of relief.

To qualify for a hardship program, you'll need to provide documentation of your financial difficulties, such as medical bills, job loss, or other unexpected expenses. Be prepared to explain your situation clearly and provide evidence to support your request. Keep in mind that hardship programs are typically temporary solutions, so it's important to have a long-term plan in place to manage your finances.

Options for Refinancing Your Auto Loan

If Capital One is unable to lower your interest rate, refinancing with another lender may be a viable option. Refinancing allows you to replace your current loan with a new one that has better terms, including a lower interest rate. Here are some steps to consider:

- Shop Around for Lenders: Compare offers from multiple lenders to find the best rate.

- Check Your Credit Score: Ensure your credit score is in good shape before applying.

- Understand the Costs: Be aware of any fees associated with refinancing, such as application or origination fees.

Is Refinancing Right for You?

Refinancing can be a great way to save money, but it's not the right choice for everyone. Consider your current loan terms, your credit score, and your financial goals before making a decision.

How to Improve Your Credit Score

Improving your credit score can increase your chances of securing a lower auto loan interest rate. Here are some tips to help you boost your score:

- Pay Bills on Time: Timely payments are the most significant factor in your credit score.

- Reduce Debt: Lower your credit utilization ratio by paying down existing balances.

- Dispute Errors: Check your credit report for inaccuracies and dispute any errors.

Is It Worth Refinancing with Capital One?

Refinancing with Capital One may be worth considering if you're already a customer and have a good relationship with the lender. They may offer competitive rates and streamlined processes for existing borrowers. However, it's always a good idea to compare their offers with those from other lenders to ensure you're getting the best deal.

Steps to Take If Your Request Is Denied

If Capital One denies your request to lower your auto loan interest rate, don't lose hope. Here are some steps you can take:

- Ask for Feedback: Request an explanation for the denial and ask what you can do to improve your chances in the future.

- Explore Other Options: Consider refinancing with another lender or exploring hardship programs.

- Improve Your Financial Profile: Work on improving your credit score and financial situation before reapplying.

Alternatives to Capital One for Auto Loans

If you're unable to secure a lower rate with Capital One, there are other lenders to consider. Some popular alternatives include:

- Local Credit Unions: Credit unions often offer lower rates and personalized service.

- Online Lenders: Many online lenders provide competitive rates and convenient application processes.

- Traditional Banks: Explore offers from banks like Chase, Wells Fargo, or Bank of America.

Frequently Asked Questions

How Often Can I Request a Rate Adjustment?

You can request a rate adjustment whenever your financial situation changes, but it's best to wait until you have significant improvements to present.

What Happens If I Miss a Payment?

Missing a payment can negatively impact your credit score and make it harder to negotiate a lower rate. Always prioritize timely payments.

Will Capital One Lower My Auto Loan Interest Rate Automatically?

No, Capital One does not automatically lower interest rates. You'll need to request a review of your account.

Can I Negotiate My Loan Terms?

Yes, you can negotiate your loan terms, including the interest rate, by presenting a strong case to Capital One.

In conclusion, while there's no guarantee that Capital One will lower your auto loan interest rate, understanding the process and preparing a strong case can improve your chances. Whether through negotiation, refinancing, or exploring hardship programs, there are options available to help you reduce your loan costs and achieve financial stability.